The question, “Who can I claim as my dependent?” has remained a top question for many taxpayers. It is an area where tax deductions and […]

Month: May 2024

Nanny and Housekeeper Tax Rules

For many families, spending time with their loved ones along with juggling work obligations means something has got to give. A solution that some families […]

FSA or HSA: Which Offers the Best Tax Advantages?

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) are two types of programs designed to provide tax advantages while paying for healthcare costs. These […]

What Does My New Health Insurance Mean for My Taxes?

In an effort to keep health insurance premiums more affordable, switching policies has become practically an annual event. This is true with many employer-sponsored plans, […]

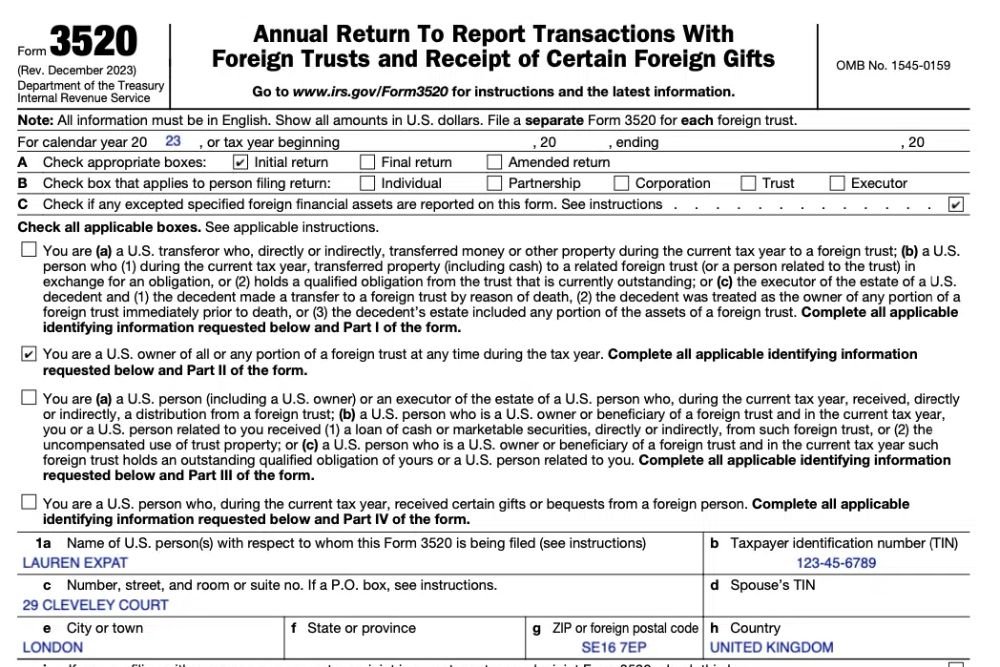

Form 3520: Reporting Gifts and Inheritances from Foreign Countries

In this increasingly global world, many of us are finding ourselves caught in the complexities of tax reporting related to income or assets that are […]

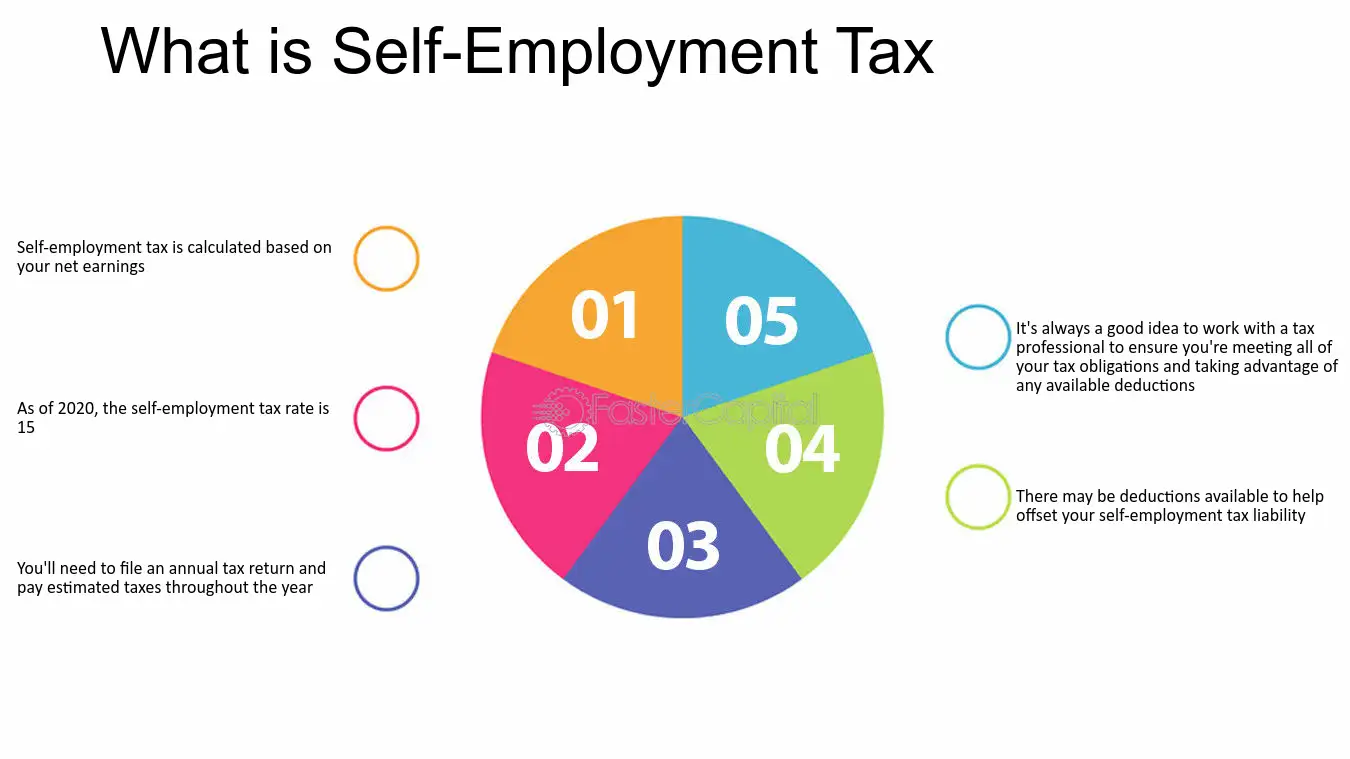

Real Estate Employment Taxes Explained

Did you become a self-employed real estate agent last year? If so, you now own your own business and can take advantage of many tax […]

What is the Inheritance Tax?

While it’s certainly not easy to discuss estate planning, learning how to establish a trust and getting your affairs in order before death can make […]

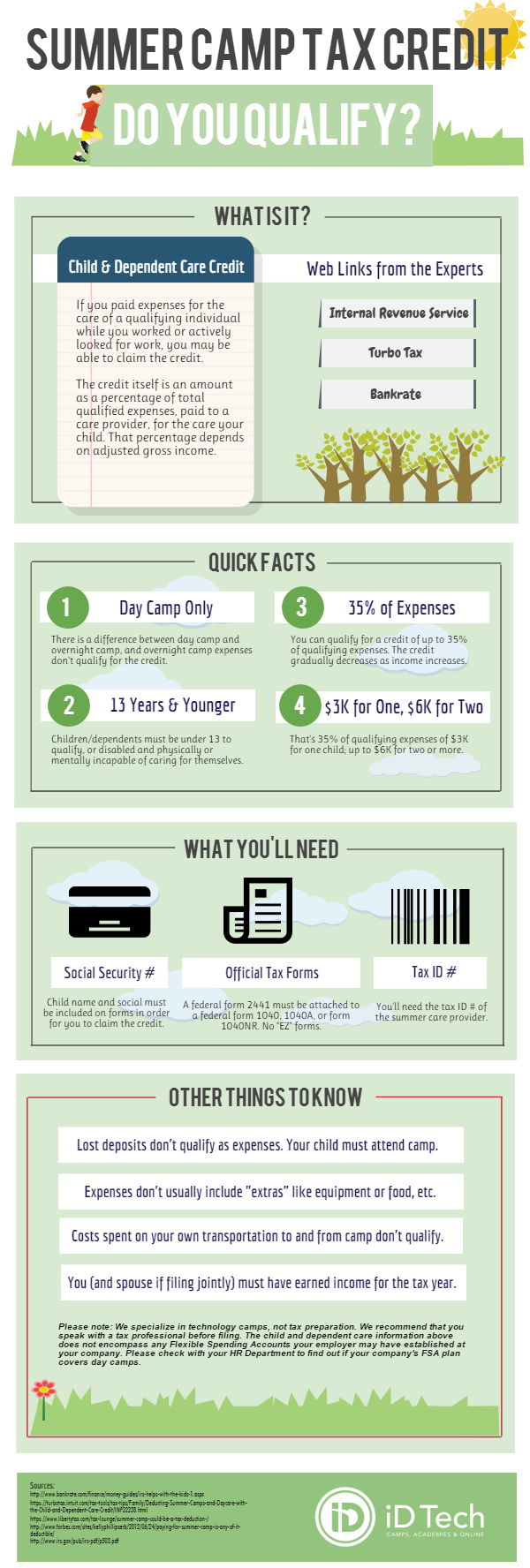

Are Overnight Camps Tax Deductible?

Summertime can be relaxing, but if you have kids on summer break, you might also struggle with how to keep them entertained and engaged while […]

Guide to Small Business Tax Forms, Schedules, and Resources

If you’re a small business owner, filing taxes can be intimidating. There are tax forms with unique due dates and schedules that you need to […]

Do Babysitters Have to Report Income on Taxes?

Working from home has been a wonderful way for parents to have more time with their children. The relative flexibility of a remote schedule allows […]